Buyers and sellers used to sit across the table, not far from extending a hand to make a deal.

These days, they might as well be sitting on opposite ends of the planet.

Between economic uncertainty and elevated interest rates, it’s getting harder and harder for buyers and sellers to agree on pricing. The result is a collapse in the investment office market. No one is making offers, and no one is closing. And what is the value of something that no one wants? Zero.

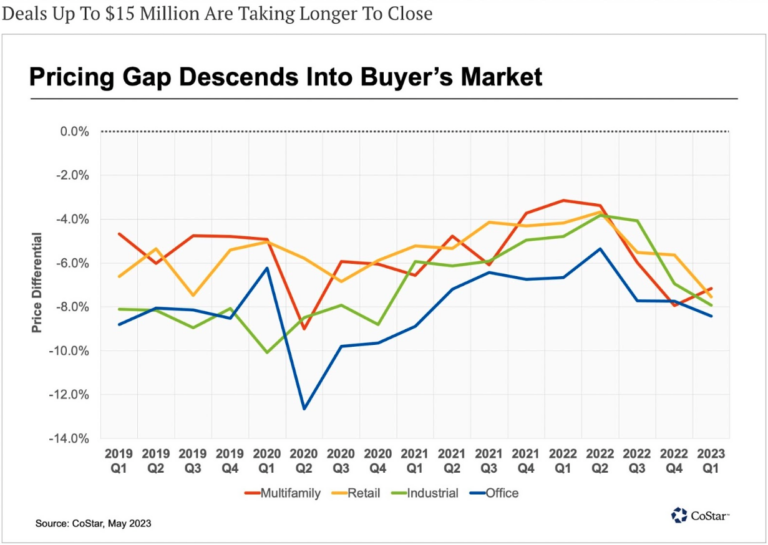

When looking at bid-ask data, a negative price differential indicates the discount a buyer paid compared to the seller’s original asking price. When that percentage slides deeper into negative territory, it signals more of a buyer’s market.

This image describes the difference between what you ask to sell vs. what you actually pay at closing. And keep in mind that many seller’s either decide not to go to market or accept terms, so the data represents sellers who agreed to transact in a really bad market…they had to sell.

Believe it or not, their disagreement is good news for you, dear tenant.

But to understand the opportunities before you, we must understand the investor.

So let’s talk about Billy Bravo.

Billy Bravo will be our pseudonym for many investors like him. We’ll use him to make sense of what’s going on in commercial real estate (CRE) currently, and to show how it all affects you.

Problem Number One

Over the past 3 years, there has been a wave of new investors like Billy Bravo in commercial real estate (CRE).

In Billy’s case, he discovered a great deal on a WeWork and bank-occupied class B office building in Uptown Charlotte in 2020. So, he pulled his holdings out of FTX just in the nick of time and bought an office building.

Billy gambled on CRE and FTX because he had trouble finding a respectable return in traditional investments.

That’s a problem because he is not experienced in real estate. In fact, Billy doesn’t even know what CRE stands for.

But his local bank made him an offer on short-term debt that was too attractive to ignore. So, he gambled that the interest rate environment would be low in 5 years when he needed to refinance. The initial return was not all that exciting, but he reasoned that he could push rents upward when the leases rolled in the next 3-5 years.

Billy may be a rookie entrepreneurial investor, but there were much larger institutional investors, like pension funds and sovereign wealth funds, following the same logic for reasons just like those that motivated Billy.

Problem Number Two

As a result of Covid, the buildings are under-occupied, and tenants will likely downsize or move when the leases roll. The average lease is 7 years long. They are rolling just a few years before Billy’s note is due.

Billy went into the deal thinking that he could sock it to the tenant’s at lease renewal time. Now Billy finds himself negotiating with tenants with all the leverage right when his note is due.

I don’t envy him. Do you?

Problem Number Three

Billy wakes up in the middle of the night, realizing that some buildings actually have a negative value. Billy is becoming a seasoned investor the hard way.

Billy’s building is now 70% vacant. So he has to make either a $10,000,000 investment to re-tenant the building, or give it back to the bank.

Trouble is, the bank doesn’t want Billy’s building. In fact, as a result of Dodd-Frank, they can’t take it. Lots of things could happen at this point: demolition, conversion, and public-private partnerships…the truth of the matter is, it is still very early in the process, and we do not know. But it will first happen in the CBD markets in cities like San Francisco and New York.

Billy? He’s out of his initial investment, his time, and a good night’s sleep. But he still has his home in Miami and his boat.

Where does that leave you, the tenant?

Believe it or not, you do have some opportunities here:

- You can negotiate lower rents in second-tier submarkets hit hard by the flight to quality by larger tenants.

- You can negotiate more flexible leases with termination options and options to extend.

- Your tenant improvement allowance offers will be more significant during your next lease negotiation, so if you can take space “as-is,” which will remove some of the financial pressure off of the landlord, you may find a bargain.

- You have more options for signature spaces like top floors and balconies with building naming rights that were held only for the most coveted of tenants in the past.

The bottom line is there will be deals for tenants who know how to negotiate.

Now is a great time to hire an advocate for your space needs.

Of course, Billy Bravo will not offer these concessions, so you need to know how to ask. Because the difference between the “asking rate and actual rate” has not been greater.

If you don’t know how to ask, don’t worry.

We created a tool called The Win-Win Worksheet™, and when you use it, you increase your chances of success to an almost unfair level.

If you’re interested in getting The Win-Win Worksheet™ for your next negotiation, we’ll walk you through it and help you get a better deal than you thought possible.

Give us a call or shoot us an email, and we’ll chat.