What Japanese chick sexer experts can teach you about finding CRE deals

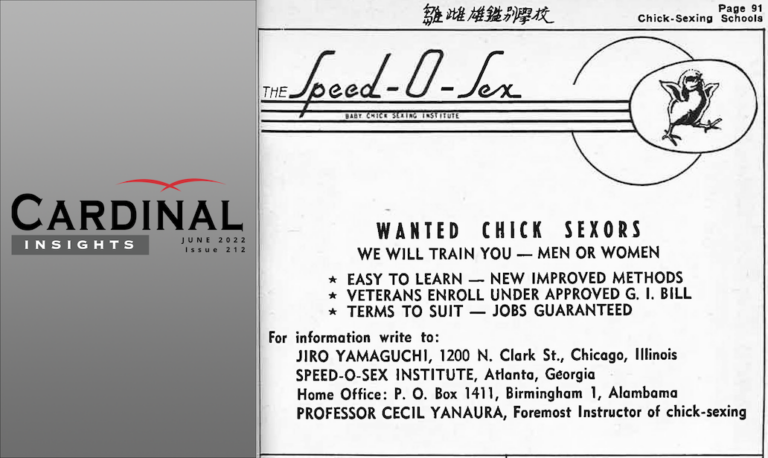

Finding a great commercial real estate deal these days involves underwriting thousands of deals — but even the most successful investors will not be as successful as these Japanese chick sexer experts!

There are chick sex specialists in Japan who execute the work of “cloaca,” which entails holding a newly hatched chick and determining whether it is male or female in a fraction of a second. What’s even more impressive is that they do this around 8,000 times a day….that’s one positive identification every 5 seconds….and they’re correct about 99.7% of the time. As you have probably already guessed, males are destined for nuggets while females are maintained to produce eggs.

You’re probably wondering: “What do chick sexers have to do with commercial real estate”? Well, like these chick sex experts, you need to cultivate an ability to swiftly analyze a real estate opportunity and determine if it’s something worth pursuing or passing on — just in time to evaluate another one.

Like Japan’s chick sexers, commercial real estate professionals rely on intuition and experience. However, if you’re like most of our clients, the depth of your expertise probably resides elsewhere. You trust Cardinal Partners to be your real estate experts.

The problem with the commercial real estate market these days is that finding a good deal is exceedingly difficult without the help of a real estate expert.

Whether you’re a business owner wanting to lease office space, an investor trying to purchase a warehouse, or a developer searching for land, the only way to get a good bargain is to roll up your sleeves and look at a lot of opportunities.

This kind of analysis is difficult and time-consuming. However, there are some shortcuts you can take. Cardinal uses the most up-to-date market research, tried-and-true checklists, and our STP Scorecard™ as a sieve to swiftly narrow down a small selection of a few properties out of hundreds of possibilities.

So, what’s the “STP” in the the STP Scorecard™? Glad you asked.

S: Buyers must recognize the seller’s circumstances that allow the property to be purchased at less than market value. It’s important to ask yourself: “What are the circumstances of the seller (or landlord)? Why is the Seller selling? Does the landlord have a lot or just a few options? Is the seller needing to make a quick deal?”

T: Shrewd investors and occupiers know the transaction features that decrease the number of competing purchasers or tenants. For example, you can ask: “Are there several — perhaps conflicting — owners? Is it a deal that has ‘hair’ and requires the unique expertise that you, as the buyer, have? Is a quick, all-cash deal appealing?”

P: You should recognize the property characteristics that provide the most value to seasoned, hands-on operators (or occupiers). At this stage, you could consider questions like: “Is there deferred maintenance? Is the property one-of-a-kind? Is the asset partially occupied or a class B property?”

Earlier this year, we started pursuing land development opportunities. We partnered with Tim Samuels of BRDLand to purchase property parcels within a one-hour drive of all of the urban centers in the Carolinas. There are hundreds of prospects! Without the STP Scorecard™, we would spend all of our time underwriting deals, leaving little time for the rigorous work that entitlement and development demand.