Want to know where all the affordable housing went?

Well, you might want to ask Mary Tyler Moore. Because it looks like we left it back in the ’70s.

Sure, the architecture and stylings seem very 21st-century when you look around. But how much bigger is Charlotte, Raleigh, or Greenville, right now, compared to 1970? Population and employment increases in these metros have been steady almost every year—and downright explosive in the last two decades.

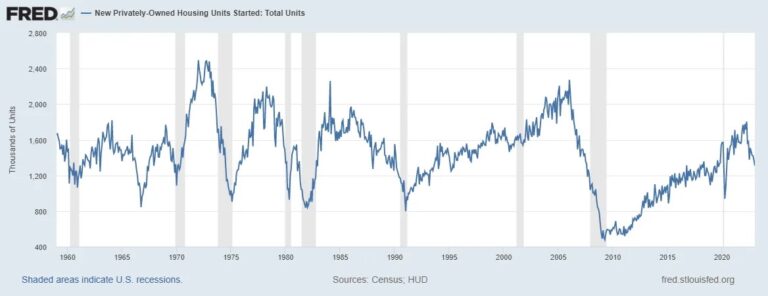

So why do our housing stats look only slightly better than the 70s? Our research department couldn’t run down the stats for Charlotte that far back, but the national picture reveals a startling truth:

See what’s happening here? The bottom line is we are not building nearly fast enough.

Most of us fortunate to live in economically booming areas like the Carolinas look around and probably think we’re building like gangbusters. But looking at housing starts, you’d think we’ve been a country stuck in the 1970s.

We’ve talked before about a big problem driving this: NIMBYism. But that’s really just one element of an even bigger problem—we don’t build things in America like we used to. And it’s costing us all dearly.

From renewable energy to transportation infrastructure to semiconductor plants…projects that require a year or two to complete elsewhere in the world can cost 4 to 5 times more and take many years longer to deliver in the U.S. The result is exactly the kind of stasis that those housing stats reveal, and the cost of that stasis gets reflected right back to us in the form of higher taxes, rent, and energy bills.

Cities and states are starting to wake up to the sobering reality of persistently high (and rising) housing costs for that very reason. Call it housing affordability, shelter inflation, anything you want, but the rent is too damn high. As a result, state legislatures are taking hard looks at curtailing local zoning authority, and growth-minded communities are updating their UDOs to allow for Accessory Dwelling Units and other innovative in-fill building options.

But we are so far behind the curve, none of that is going to make a difference any time soon if we can’t figure out how to REALLY step on the gas.

This is not simply a matter of partisan politics. NIMBYs (and YIMBYs) can be found on both sides of the aisle.

No, it feels like we’ve all just resigned ourselves to the status quo and have accepted the old adage that “it is what it is.”

We all in the Real Estate Industry are vested in tackling this problem with gusto. After all, a robust building sector is our most essential raw material. However, everyone in the American economy suffers when we constrain supply and set the table for runaway shelter inflation.

So, what can we do? Two things:

#1: Encourage, support, and commit to more market-rate building.

It’s surprisingly counterintuitive to most people, but the truth is, if you want more affordable housing, you have to build more market-rate housing. It’s easier to finance, there’s plenty of demand, and it’s what we’re good at.

One of our favorite economics writers, Noah Smith, published an excellent piece on his substack that makes the case for market-rate housing as clear as the title: “Market-rate housing will make your city cheaper.” (The full article may require a subscription, so if you want a copy, let us know.)

San Francisco and other cities have learned this lesson the hard way. They restricted market-rate construction for so long that everything got more expensive for everyone. They discovered that when you start bulldozing parking lots for gleaming new towers full of market-rate apartments, most of the new tenants are tech workers leaving older units in other parts of town. And the landlords don’t want the apartments those tech workers left sitting empty too long….so the rents come down.

With the delivery of 9,000 new units this year in SouthEnd alone, the odds are good that this plays out in Charlotte exactly the same way. (In fact, we’d say those odds are even better than the Hornets NOT making the Playoffs this year.)

So, building more market-rate might provide some relief. But, it only scratches the surface of the housing deficit we’ve been running up for the last couple of decades. That’s why, if we really want to leave the 70s behind for good and scale this up to the level that the Carolinas (and the country) really need, we simply must transform our way of thinking.

Which leads to our second point:

#2: Develop a 10X mindset.

If you’re a regular reader, you know we are fervent adherents of the professional and personal growth strategies laid out by Dan Sullivan and the team at the Strategic Coach.

One of the most important lessons they teach is the importance of a 10X growth mindset.

All of us try our very best, each day, to get a little better in everything we do: better at gaining a few more dollars, a few more deals, reducing stress, improving productivity, and so on.

These efforts can add up over time, and usually result in nice, linear progress. It’s the 2X growth default setting.

But something powerful and very tangible happens when you radically adjust your goals to 10 TIMES more than what you think is possible: Your focus becomes more powerful, your associations more productive, and your impact multiplicative.

We coach some of our own clients to use a 10X mindset on their projects so they can get outsized results when mere “successful closings” would have been sufficient. It’s not for everyone, for sure. It takes seriously focused attention and commitment. But when it comes together, it’s transformative.

And to be frank, nothing less than this kind of visionary focus and execution will break us out of the inflationary building stasis we’re stuck in. Policymakers, investors, government agents, tenants, owners, and citizens all have a role to play.

It’s time to take off the dancing shoes and put on the hard hats. It’s time to build. Let’s get to work.

P.S. Got a project that can help us get to 10X? Want to walk through a 10X Mind Expander exercise together and re-envision the possibilities for your company’s real estate strategy? Give us a call, and let’s meet soon. We are all way behind schedule, and there’s no time to waste. We are here to help!