In the commercial real estate (CRE) markets, there is an unprecedented $205.5 billion in unallocated capital, commonly called “dry powder,” waiting for the opportune moment to be invested.

This current situation presents another opportunity for value investors who previously capitalized on the real estate downturns following the 2008 financial crisis, the dot com bust, the early 1990 bust, and the S&L crisis.

It’s also a great opportunity for those of you who aspire to be one of the lucky ones who buys real estate at the bottom of the market. After all, as the saying goes in CRE circles, “you make your money going into a deal.”

If this is you, I’d suggest monitoring three emerging trends in this declining market and watching out for the following opportunities:

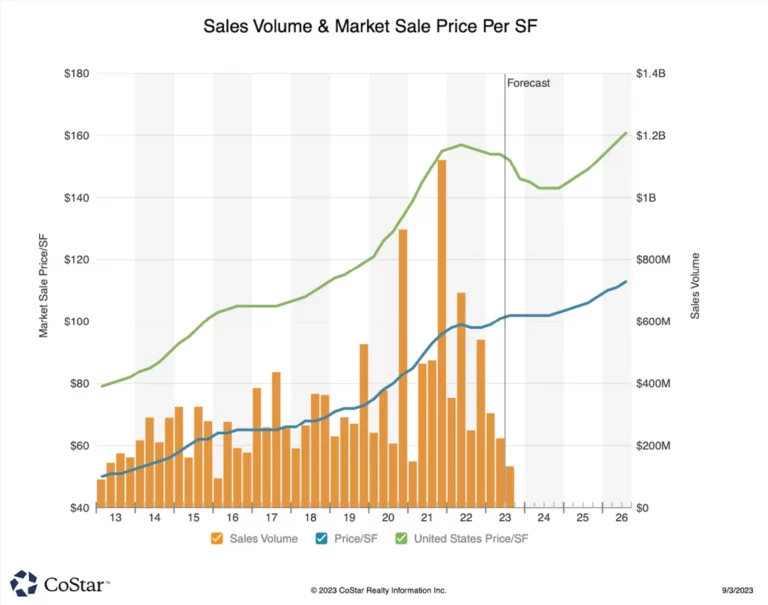

- Decrease in U.S. property values: The average CRE price has declined 16% since its peak in March 2022. Office property values have been most affected, with a significant 31% reduction in value.

The opportunity: buyers should look for sellers with impending short-term debt coming to term or properties significantly impacted by the surge of work-from-home trends, among other seller characteristics. - Manufacturing and warehouses: Unlike their office counterparts, warehouses have managed to weather the storm somewhat, suffering only an 8% decrease in value.

The opportunity: Professional buyers can offer transaction structures that limit competitors with cash closings and quick due diligence on properties with upside for expert, “hands-on” CRE practitioners. Knowing how to structure a deal is more important than ever. - Multifamily and rental properties: Income-producing housing prices have dropped by approximately 20%.

The opportunity: Hands-on investors now have numerous potential investment opportunities, particularly for investors who have deep knowledge of property characteristics.

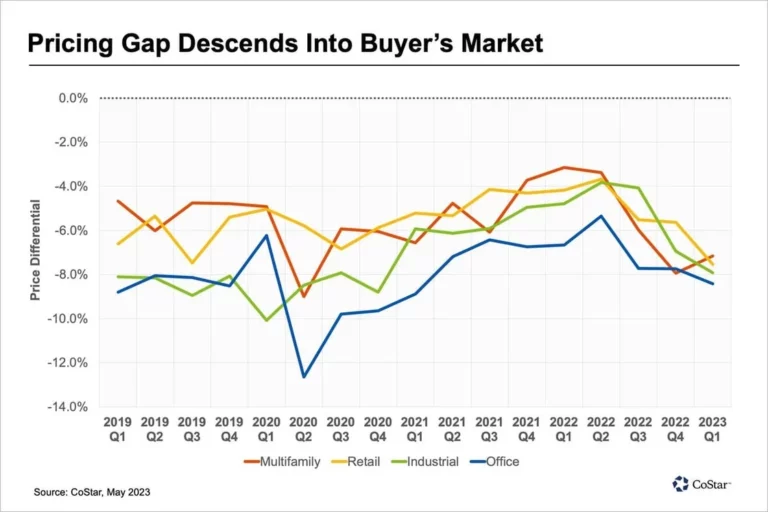

The big bid-ask gap: Sellers are stubbornly sticking to yesterday’s pricing, resulting in a bid-ask gap that’s as wide as the Grand Canyon. For multifamily apartments, this spread has ballooned to 11%—levels not seen since 2012.

Office and retail spaces have a slightly less dramatic but still significant 8% spread, while industrial and warehouses are playing it cool with just a 2% difference.

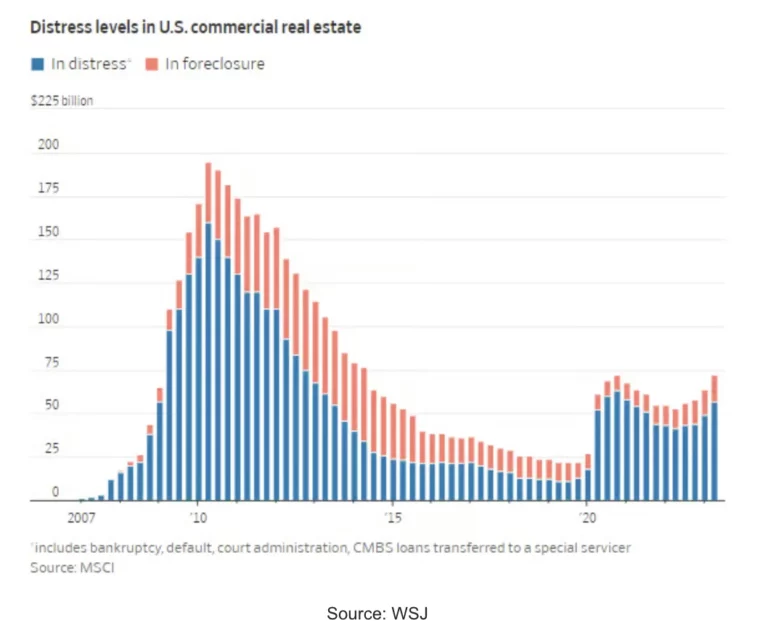

Refinancing difficulties: Although foreclosures are not currently widespread, the value of distressed properties in the United States has increased, reaching a total of $71.8 billion. This number will likely continue to rise as loans reach their maturity dates and property owners face difficulties in refinancing.

The opportunity: As distressed properties increase on the market, new investment opportunities will open up to the savvy investors looking for them.

Of course, it’s one thing to monitor multiple trends like this.

It’s another thing to know how to identify the opportunities we’ve mentioned.

Even more challenging is acting on those opportunities.

Fortunately for you, we developed a simple, step-by-step method for taking care of both. And in a market as dynamic as this, it’s key to securing deals below fair market value deals.

It’s called the STP, and it stands for knowing three things about a potential acquisition: the Seller’s circumstances, Transaction terms, and Property characteristics.

When you understand the Seller’s circumstances, you gain insights into potential deals below fair market value, like when a seller needs to sell quickly, has poor market information, and has low pricing expectations. In markets like these, savvy “value” investors seek out the owners who look like the cat with a long tail in a room full of rocking chairs.

When you master Transaction terms, you can minimize your competition. The big winners are the investors who can offer transaction terms on messy portfolios in multiple markets and perform due diligence quickly in a way that competing buyers can’t. Experienced investors have a toolbox of deal terms to apply to any deal, resulting in a win.

And finally, when you recognize the unique Property characteristics where you can add value, and where few others see the potential, you’ll be able to buy the asset below its fair market value (FMV). You’ll know to look for property characteristics such as being unique, old, having deferred maintenance, and rents below market. (Of course, nothing about these properties is sexy unless you are an accountant—and you will not want to discuss these assets at a cocktail party.)

Are you interested in unique opportunities and leveraging the STP approach to your advantage in the dynamic CRE market? Do you want to identify unique property characteristics, understand seller circumstances, and master transaction terms that minimize competition?

If so, it’s time to make a move.

Don’t wait. Call Cardinal Partners today, and let’s create strategic positioning and value together in this market.