Cardinal’s prediction for office space? Well, since we started quoting pop music in our last newsletter, let’s ask our old friends Bachman-Turner Overdrive:

“B-b-b-baby you just ain’t seen n-n-n-nuthin’ yet.”

There’s a lot more pain to come, and it will get worse before it gets better.

The amount of debt coming due on office space alone makes you want to crawl into a hole and wait for it to pass.

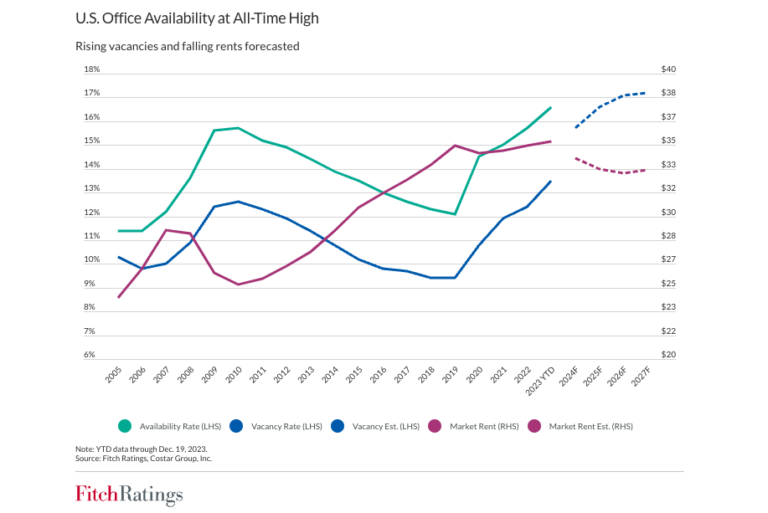

“Fitch forecasts U.S. CMBS office loan delinquencies to jump to 8.1% in 2024 and 9.9% in 2025.” – Fitch Wire, December 21,

But here’s a point we’re willing to bet our beaks on: When it gets better, it will be NOTHING like before.

Just consider the historical context of the modern office: it only recently solidified its place in the canon of work environments—in the post-1970s era.

Distinct from early 20th-century commercial buildings, the archetype of the office building as we typically recognize it—the high-rise filled with cubicles and conference rooms—represented a transition from the industrial age into the information age, with layouts and designs inspired by factory models, all in the pursuit of peak productivity among office staff.

In fact, the iconic open-plan office layout, theorized by the Quickborner team in Hamburg, Germany, during the 1950s, truly began to shape workplaces during the late 20th century, underpinning the overall shift to modern office architecture. The invention of the typewriter precipitated the first formal organization of “office workers” in structures that emulated factories for the mass production of “copy.”

Personal computers and, later, laptops, created both a desk-bound AND globe-trotting workforce that needed privacy, mobility, connectivity, security, and much more. Buildings followed suit.

Today is no different. 20-acre data centers in the middle of nowhere are not just being built for the future of consumption…they are as much about the future of work as anything else.

And that spells OPPORTUNITY.The WSJ’s Future of Everything newsletter (one of our favorites) recently illustrated that business leaders are not sitting on their hands while the race-to-the-bottom bidding wars over patches of real estate we nostalgically call “office buildings” plays out.

No. Business leaders are leaning into the technological and social tableau rapidly evolving before us to transform every aspect of work life, even the dreaded meeting. Here’s a sample of the prognostications CEOs and consultants relayed in the WSJ article:

- Envision hologram-filled conference spaces and virtual reality environments that dissolve the barriers between remote and on-site team members, creating a seamless collaborative experience.

- Picture the shift from static boardrooms to dynamic, screen-free walking meetings that echo the newfound freedoms of remote work break times.

- Imagine more captivating meeting agendas, amplified by collective input and strategies honed on collaborative platforms before the meeting even begins.

- Consider swapping the routine office meetings for invigorating quarterly retreats, blending work and leisure at scenic resorts or vibrant co-working hubs.

- And finally, anticipate the integration of mixed-reality and AI innovations, offering personalized coaching and strategic preparation to make every meeting count.

It’s a brave new world right now. And we’ve seen it firsthand with our clients—more shared resources and platforms….all culminating in face-to-face meetings and events with higher impact results.

And every participant leaves the office saying the same thing: “We should do this much more frequently.”

Serious question: How long do you think the stakeholders of those ever-more efficient gatherings, who get so much energy and improvement from interaction with their colleagues, will be content with a traditional meeting?

Especially as stakeholders continually experience the invigorating impact of efficient and dynamic gatherings…how long until the charm of the boardroom begins to wane? The answer is “last year.” That was when Wells Fargo announced a $500M commitment to facility upgrades for their 27,000 employees across the Charlotte region. It’s well underway in Uptown and already delivering in University City, with updated floor plans that include hot desks, huddle rooms, and “upscale micro-markets.” Their plans include a “complete overhaul” of the top 3 floors of 550 South Tryon that will be accessible to any employee in the market.

“We’re taking the best floors in our footprint and giving them back to the employees.” – Valerie Goble, Wells Fargo

The future of work is as REAL as it ever was.

Real connection. Real people. Real places. Real Estate.

We’re not convinced that the crazy cost structure of office-to-residential conversion will transform the nation’s CBDs into a destination urban residential resort. No way.

And we also do not believe that the uptown Class-B office tower is functionally obsolete.

So, how, you might ask…

…amid smoldering repossessions, still-collapsing office rents, and 50% occupancy rates, does a value investor separate the wheat from the chaff and find this generational opportunity?

Well, we have a secret weapon. It’s called The STP Scorecard™.

We use it to help our clients find the kind of upside that can turn an empty office tower into a hive of flex workers from miles around.

Of course, while The STP Scorecard™ is a revolutionary tool for value investors seeking rare diamonds in the office real estate market, its utility extends far beyond that single asset class.

The scorecard’s strategic insights are equally adept at guiding purchasers of various asset types, including land, industrial spaces, and retail properties. Use it once, and you will use it for everything.

For example, just last week, John Culbertson, partner at Cardinal Partners, used it to help his son think through his decision to buy his first car.

The guiding philosophy behind The STP Scorecard™ is this: With just 30 targeted questions, it meticulously evaluates the Seller’s Circumstances, the Transaction Structure, and the Property Characteristics—and uncovers a winning deal.

Its simple approach pinpoints the potential for below-market real estate transactions.

If you’re interested in harnessing the full power of The STP Scorecard™ and unearthing the untapped treasures in the real estate market, connect with us today. We’ll show you the profound impact it can have on your investment strategy.

Seize the moment and leverage the declining values in today’s office markets to set yourself apart from the competition: Reach out now to unlock the potential of your next investment!